The first thing to say is that nobody can always predict when a dip will come and how long it will last. The only certainty is that they will come. However, we can learn a lot about dips that occurred in the past to significantly improve our chances of profiting from them.

If you haven’t experienced a crypto market dip before, chances are that it will cost you a lot of money. Even if you have and still do not know how to correctly react to them, you could still lose a lot of money by getting out too late (if you want to) or buying too early. This was me in 2018 as I held on to all my cryptos and lost over 60% of my bank. I decided to write this because I saw friends and family make the same mistake in 2021/2022.

At the end of this article, you will know how to identify market dips and 4 ways you can react to increase your bag during dips. Remember the old quote; Bull markets make you money, Bear markets make you rich.

How to identify a crypto market dip

There are many ways to identify when the crypto market is bearish including looking at

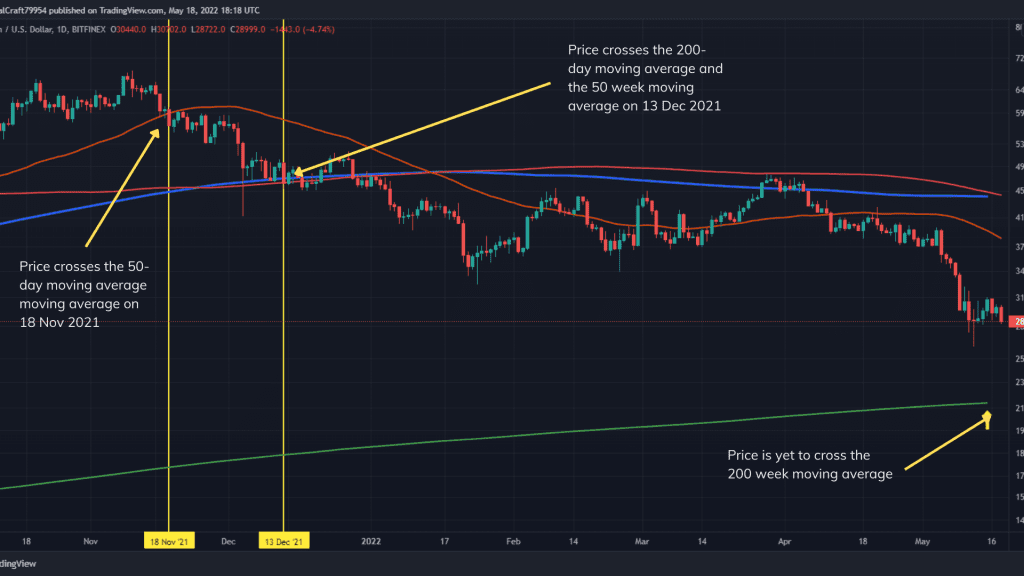

- price crossing below the 50-day moving average

- price crossing below the 200-day moving average

- price crossing below the 50-week moving average

- price crossing below the 200-week moving average

These are just a few and there are many more.

This chart shows price crossing below (yellow arrows) the 50-day, 200-day, and 50-week averages while approaching the 200-week moving average. Obviously, the daily moving averages will get you out of the market faster but may get you back in prematurely.

As long as you accept you will not call the exact day the market turns bearish; the particular method you chose doesn’t matter, pick one and work with it.

How long will the crypto dip last?

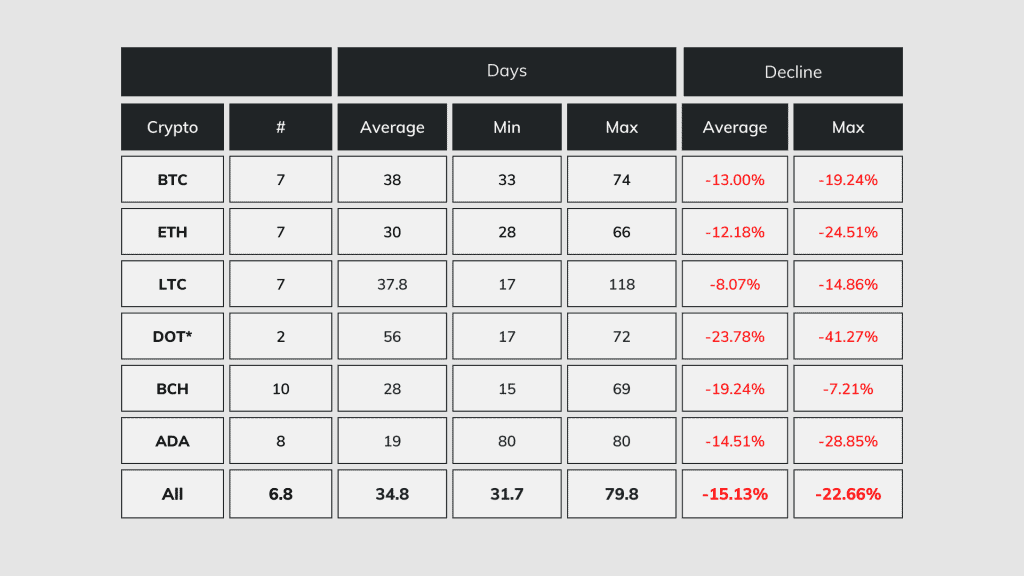

If we look at recent data, from January 1, 2019, and measure the dip from when the price crossed below the 200-day moving average to when it crossed back above, the Bitcoin dips have been on average 38 days since 2019. The maximum has been 74 days (2 and a half months) and the minimum has been at least 33 days.

The numbers for Ethereum are similar, with an average of 30 days and a minimum of 28 days, and a maximum of 66 days.

*DOT is from 2020

So, in recent times, as long as you are holding good crypto and are willing to hold for about 2 and a half months, the price should bounce back.

How to buy the dip crypto

There are broadly 4 ways to handle crypto dips

- Hold on for dear life (HODL)

- Exit the market (sell & re-enter after the market rebounds)

- Dollar-cost average (DCA)

- Buy the dips

We will look at the pros and cons of each approach and examine what the data shows

HODL

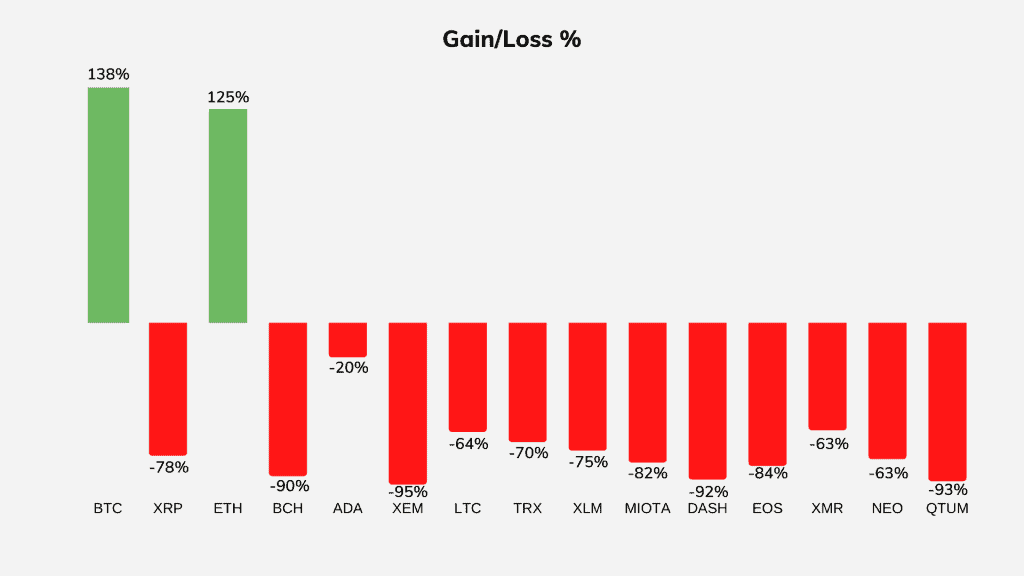

Should you hold your coins (HODL) when the crypto market dips? Yes and no, it depends. If you are new to Crypto, you will hear a lot of people saying this is the way to go, diamond hands and all. While so far it has been true for Bitcoin and Ethereum, you can’t say the same with Altcoins.

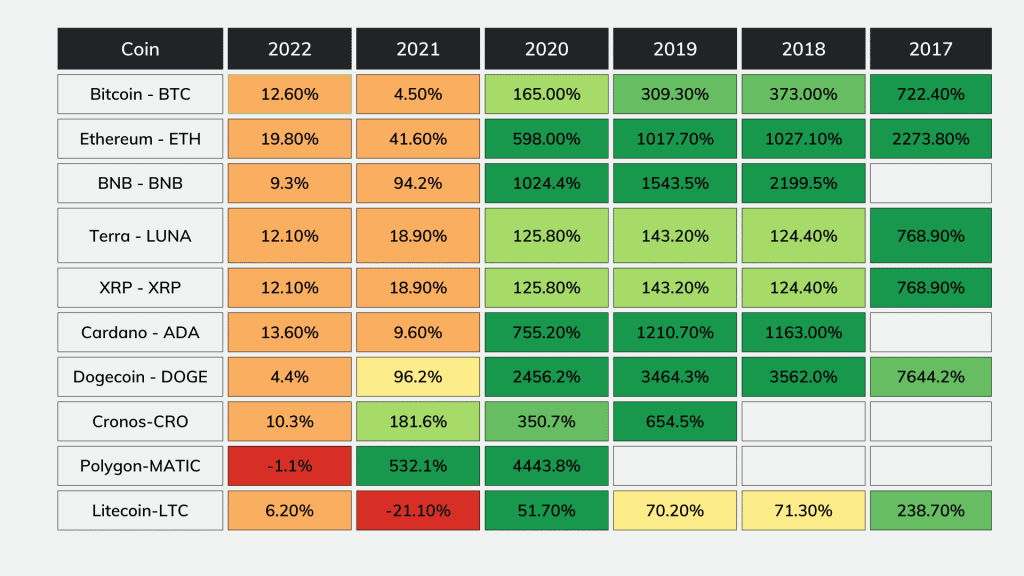

If you look at the top 15 Cryptos in 2022, it will seem like this is true. However, there is survivorship bias here.

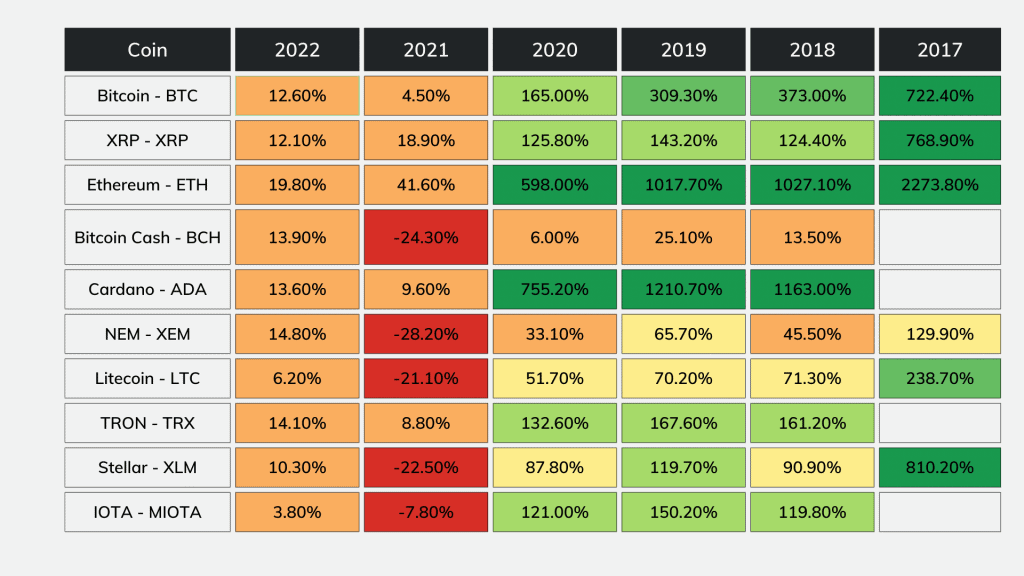

If we look at the top 15 cryptos from 2018, we see a different picture. Only 2, BTC and ETH, are above their 2018 open price. So, if you were HODLing any of these other “top” cryptos from 2018, you will still have been down as of March 31, 2022

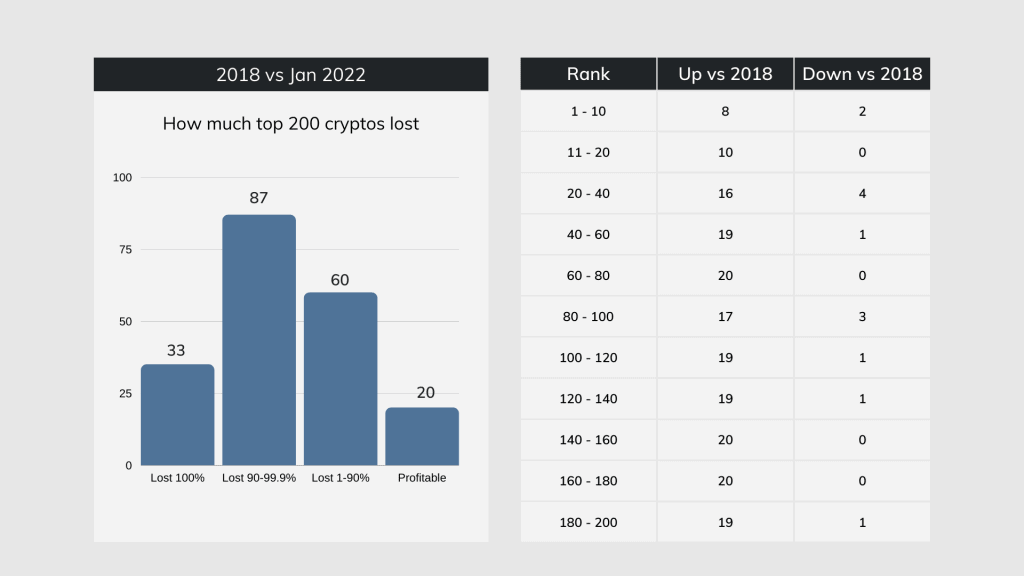

If we look at the top 200, the picture is even worse.

33 out of 200 have lost 100%, 87 lost over 90%, 60 are in a loss position, while only 20 (10%) are above their 2018 open price.

All this assumes you bought at the beginning of the year, not at the highs.

If you want to hold, hold either Bitcoin or Ethereum or hold a coin you have thoroughly researched, and are sure of the fundamentals. Otherwise, holding because Crypto will always go back to its previous high will lose you money about 90% of the time.

Sell your crypto

Some favor this approach, but it has its pros & cons.

Pros

- You preserve your cash which you can invest elsewhere

- You reduce your losses

- It is simple

- The market may never come back

Cons

- Historically, this would not have been the best approach for very bullish coins like BTC & ETH & later SOL and ADA

- You might miss a giant move up

- You have to monitor the markets constantly

Crypto dollar-cost averaging (DCA)

This is a strategy where you buy a fixed amount at set periods. The periods could be daily, weekly, or monthly. This is because you believe that the asset’s price will go up in the long run, and it is impossible to time the market. So, the best thing to do is to buy a fixed amount periodically. This is also a good method if you do not have a lump sum to invest.

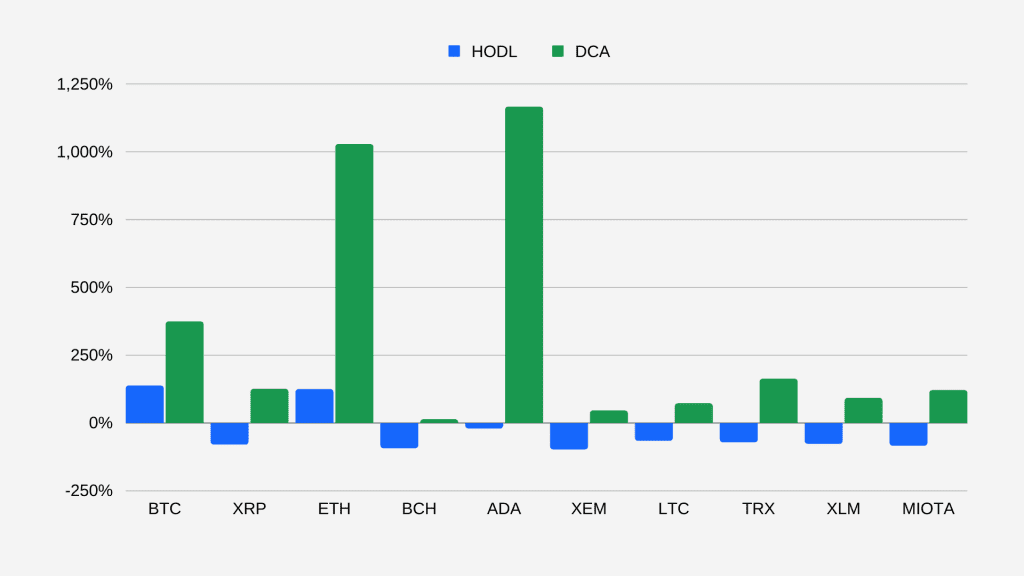

blockchaincenter.net, has an excellent chart on how DCA would have performed depending on when you started, and the data here is obtained from there.

Looking at the chart above, if you started to DCA into the top 10 coins at the beginning of the year, apart from Polygon – MATIC, all other currencies would be in profit in 2022. This is very good when compared to buying at the start of the year and holding as all coins are down against their 2022 start price.

What if you started in 2018 when we had the crypto winter? If you had bought and held, you would be sitting on very decent profits now in 2022 – 3464% for Doge, 2199% for BNB, and over 1000% for Ethereum and Cardano.

Even if you started to DCA into the top 10 coins in 2018, you would still be profitable for every coin if you held until 2022

Looking at DCA vs. HODL for the top 10 Cryptos at the beginning of 2018, we can see that DCA easily beats buy and hold (HODL)

If you do not have the time to research crypto fundamentals and want to do more than hold, this could be the best method for you. The safest cryptos to hold are Bitcoin and Ethereum; however, they will not be the best performers over the next few years because of their already high market capitalizations (market caps). So, if you are happy to take on more risk for potentially more reward, then this is better than Holding through the dip

Buying the Crypto dip

This is the most challenging approach to implement because how do you determine the dip? If you knew the answer to this, you would be one of the wealthiest people in Crypto. For most people who have successfully done this in the past, luck is a big reason for their success.

Despite what you might read or hear people say, if there was a reliable way to predict the bottom of the market, everybody would be doing it, and nobody would buy at any other time. So, you might be asking now, what do I do? Should I buy the dip? If you believe strongly in an asset and have your idea of what the true value of that asset is, anytime the price falls below that true value; you should buy.

Unfortunately, this is not so easy with Crypto, and in reality, practically all coins are above what would be considered their intrinsic value. However, let’s look at some methods that worked in the past.

We will look at examples with Bitcoin as we all know that all coins are strongly correlated with Bitcoin, and Bitcoin drives the crypto market.

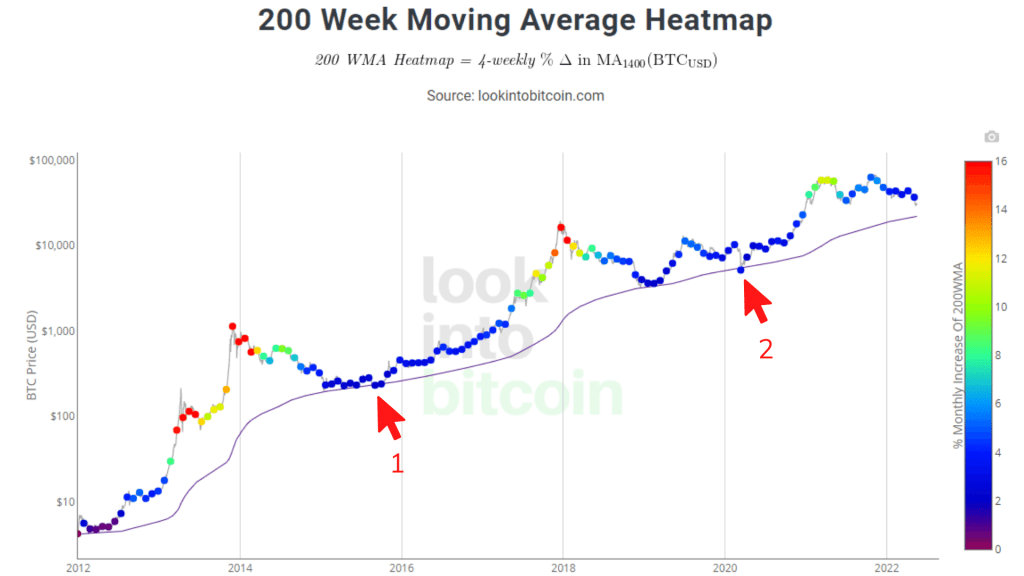

Bitcoin 200 Week Moving Average

This example is taken from the excellent https://www.lookintobitcoin.com/

Buy when Bitcoin’s price is below the 200-week moving average. This has happened twice in 10 years. You could also say the dark blue periods would have been good places to buy for additional purchases.

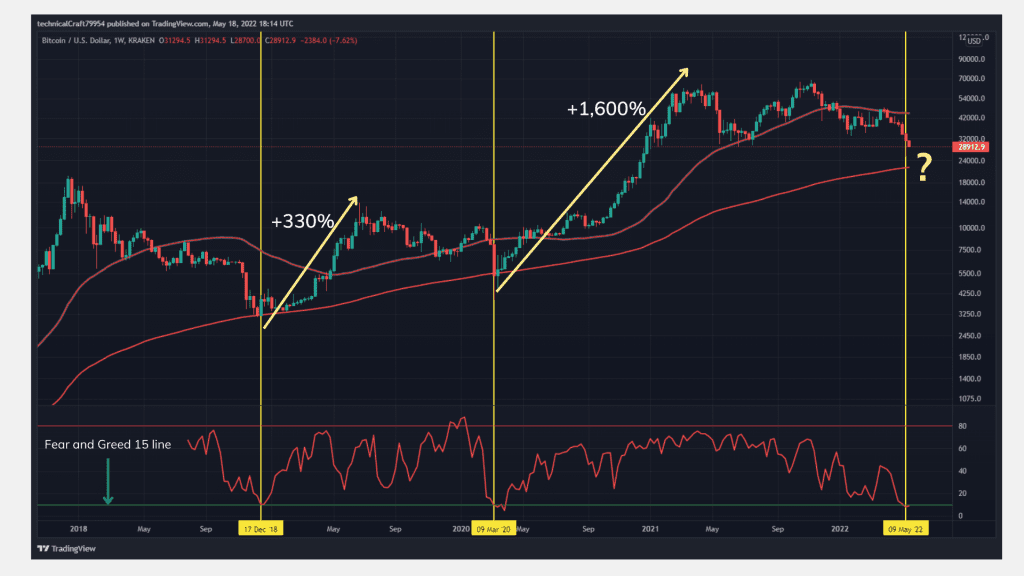

The Bitcoin Fear and Greed Index

The strategy here could be to buy when the weekly score is below 15, which has happened about 3 times in the recent past. It looks like these would have been good times to buy.

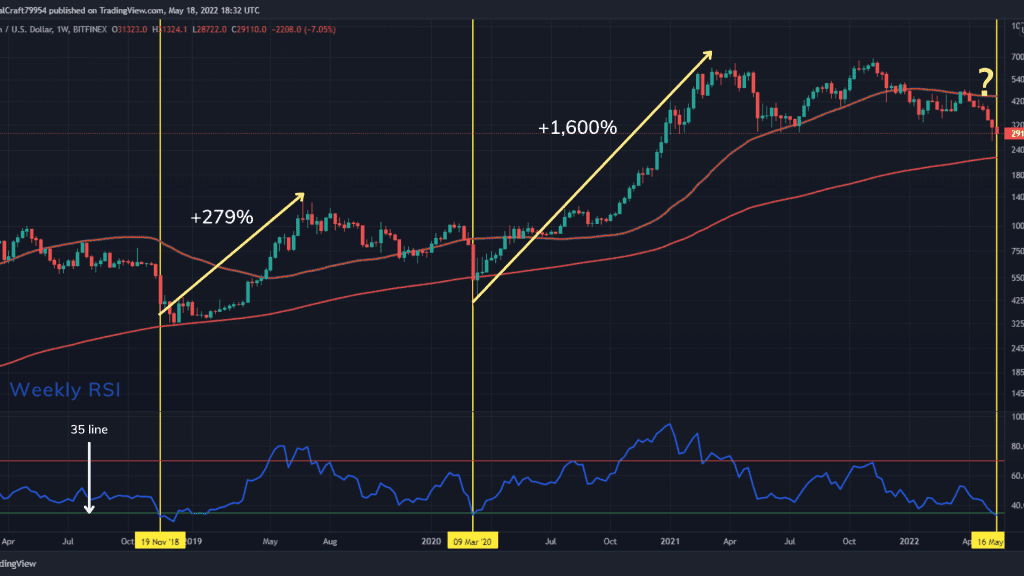

The Bitcoin Weekly RSI

Buy when the weekly RSI is below 35. This has happened twice in the last few years and would also have been a good time to buy. RSI is currently (16 May 2022) below 35 and we will know in a few weeks if this strategy still works and if this was a good place to buy.

The problem with these methods for buying the crypto market dip is that while they are very profitable, the opportunities are few and far between, which means you would have been out of the market for long periods. At best, this is a strategy to supplement your primary system, as staying out of the market this long would be difficult in practice.

Final thoughts

Based on what has happened in the past, the best way to win with crypto market dips is to

- Identify good crypto projects

- Dollar-cost average into those projects

- Put some cash aside and buy the crypto dip

- Trade using solid technical analysis

A suggested strategy could be 70% DCA into good projects, 20% for buying the dips, and 10% to trade around any good system based on solid technical analysis. This is how I have more than 30x my investment in Crypto in the last four years.