10X your crypto profits in a bear market

The number 1 mistake people new to crypto make is believing that the best way to invest in crypto is to hold crypto forever. I will show you data to prove that if you do not take profits, you are pretty much guaranteed to lose money in the long run.

During 2021 we saw prediction after prediction practically guaranteeing that Bitcoin would hit $100k by December 2021, ETH would be $15,000 and Solana would be $1,000 and all you have to do is hold crypto.. We all know how those predictions turned out.

When you are new to crypto you also hear stories about how people invested $1,000 and were now millionaires. Sadly, in the end, many actually lose money.

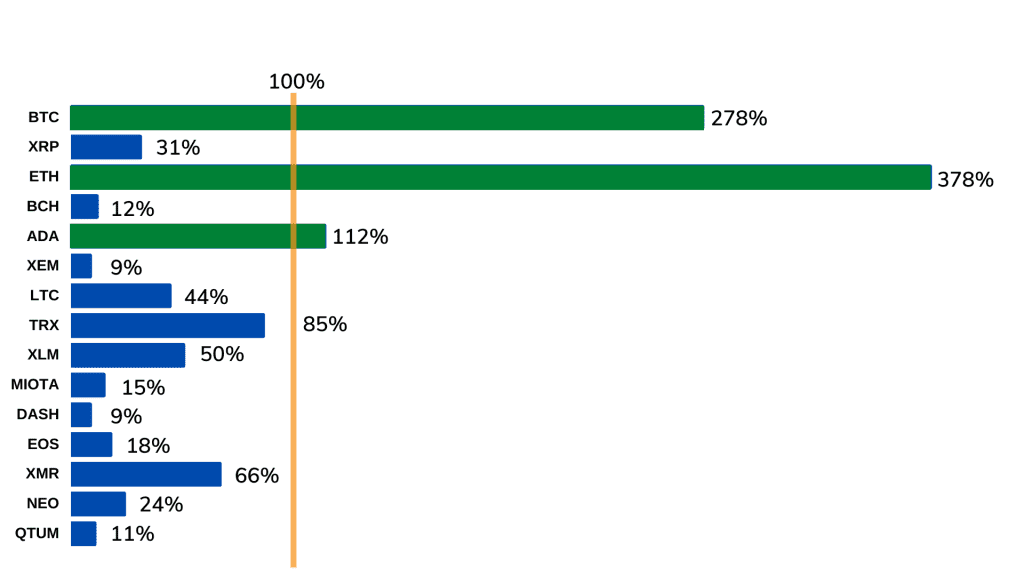

You may not realize, until it is too late, that cryptos don’t always come back. The stories you see are selected examples and compared to 2018, only Bitcoin and Ethereum are actually better than their 2018 price.

Going forward, is the answer only to buy Bitcoin and Ethereum? It is not that simple. Bitcoin and Ethereum have experienced a lot of growth in the past and will not achieve that same growth. Altcoins will perform better, some may still 10X and even 100X. The trick is knowing when to take profits and again, I will show data on some ways to take profits from cryptocurrencies with a simple strategy that beats buy and hold.

Hold crypto vs this simple trading strategy

The strategy is simple.

Long trades

Buy crypto (go long) when the price crosses above the 200-day moving average (200-day MA) and remains above the 200-day MA at the end of the month. Exit when price crosses below the 200-day MA and remains below at the end of the month.

- Entry (Buy): Price is above 200-day MA on the last day of the month

- Exit (Sell): Price is below 200-day MA on the last day of the month

Short trades

For short trades, do the opposite. Sell (go short) when the price closes below and remains below the 200-day MA at the end of the month. Exit when price crosses above the 200-day MA and remains above at the end of the month.

- Entry (Buy): Price is below 200-day MA on the last day of the month

- Exit (Sell): Price is above 200-day MA on the last day of the month

Can’t be simpler than that, can it?

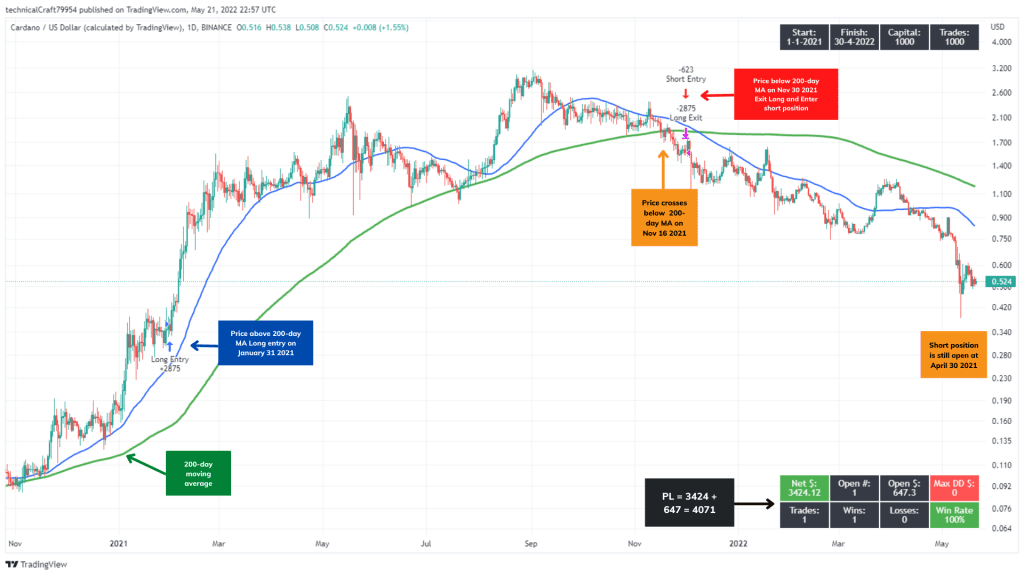

Visualizing the strategy

A picture of the strategy automated in Trading view using Cardano – ADA between January 1, 2021, and April 30, 2022. So far, the system has triggered one winning trade and one open trade still in profit.

How does this crypto trading system perform?

We will look at how the system performs in a bear market as well as a bull market. We will look at the top 15 cryptos at the start of the year in both cases. We will use a fund of $15,000 and invest $1,000 in every crypto

Bear market Jan 01, 2018 – Dec 31, 2018

Buy and hold -86%

200 Day MA system -8%

Overall result

[wptb id=47383]Hold crypto or trade crypto?

[wptb id=47409]Some more arguments against buying and holding crypto

While buying and holding lost money for all coins, the 200-day system actually made money in 7 cases in the worst crypto bear market.

12 out of 15 coins are currently (April 30, 2022) below their 2018 open price.

Bull market Jan 01, 2021 – Apr 30, 2022

Buy and hold crypto 250%

200 Day MA system 245%

Overall result

| Net profit/-loss | 37,429 | 36,678 |

| Initial capital | 15,000 | 15,000 |

| ROI | 250% | 245% |

Result by crypto

Initially, this looks like buy and hold is performing slightly better but dig a little deeper and you see 2 things –

The 200-day system has some open short trades that will continue to make money.

The buy and hold system has lost 50% in 2022 and will continue to lose money.

I am sure if I run this system again in a month, it is likely the 200-day MA’s ROI will have surpassed the strategy where you buy and hold crypto

How best to use this crypto trading strategy?

This strategy works best with strong trending cryptos. It can even work with Tech stocks like Tesla, Apple, Google, etc

The system will not work well for cryptos or assets that are mature and move sideways. Will not perform well with FX markets which mostly trade sideways, in a range.

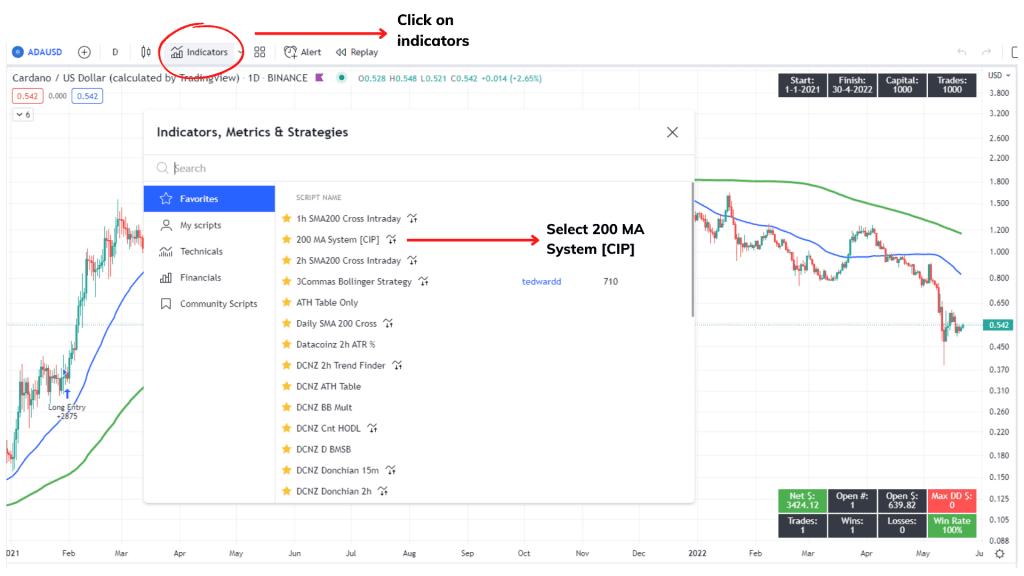

How to easily test this strategy

Head on to trading view and test for yourself

Go to trading view, sign up, search for this free indicator 200 MA System [CIP], and apply to any crypto.

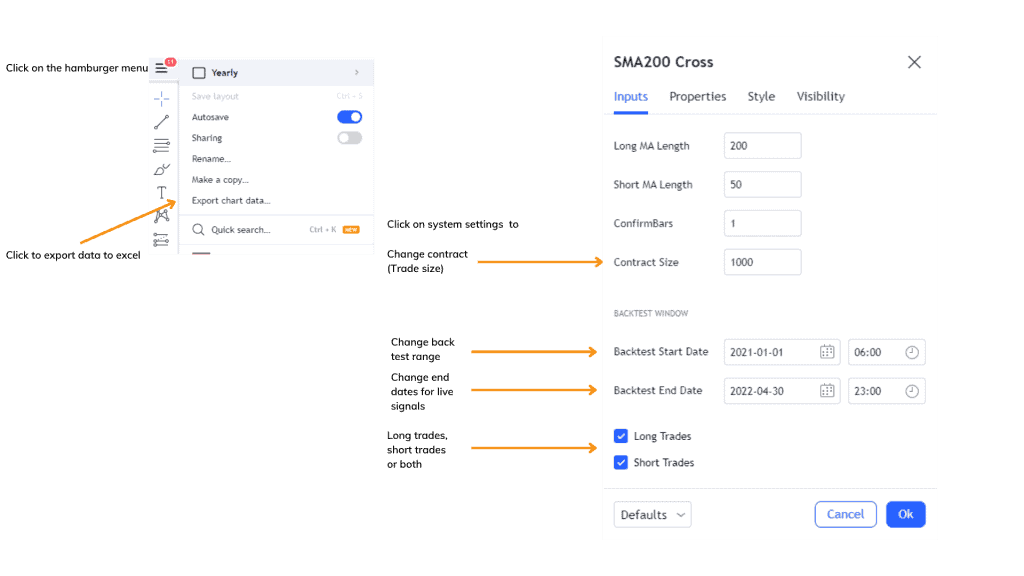

In Trading View you can

- Export the data to excel

- Change the contract size

- Change the backtest range

- Configure for live trading signals

- Choose to take long trades, short trades only or both

How to short cryptos

To get the best out of this system it is best to take long and short trades. Short trades are when you believe the asset price is going to go down, so you sell the asset now and buy back later when the price falls. To do that you have to trade futures or borrow the asset, sell it and buy back after the price drops.

How to short cryptos in the UK

If you are in the UK, futures trading is not permitted for the average investor. None of the main exchanges is licensed by the FCA (UK regulator) to provide this service. The alternative is to borrow the crypto on a decentralized exchanges or on Binance. I prefer to do this on Binance as the liquidity ensures you get the best prices. Also, your funds are at less risk as many of the decentralized platforms have been hacked in the past.

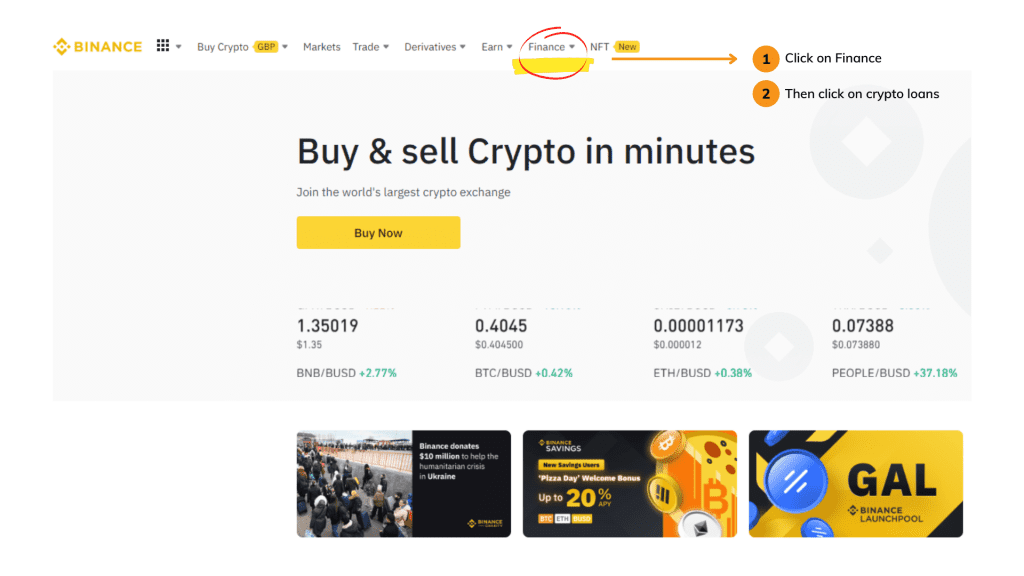

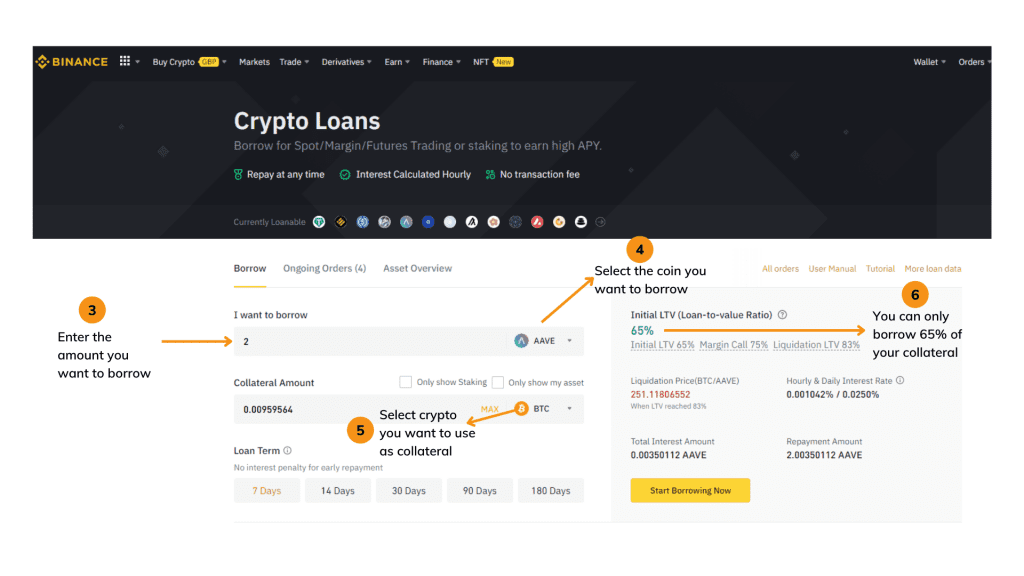

To use Binance Loans, register or log in to your Binance account then

- Click on the Finance menu

- Then click on crypto loans

- Enter the amount you want to borrow

- Select the coin you want to borrow

- Select crypto you want to use as collateral

- You can borrow up to 65% of your collateral

If you want to know how long to hold your crypto, hold until price crosses below the 200 day moving average. This will protect you in crypto bear markets and earn you good returns in bull markets.

That’s it, that is all you need to know to 10X your crypto profits. If you have any questions about anything covered in this article, please comment below.